"Helping BUSINESSES and Individuals Achieve Their Financial Goals By Maximizing Funding Approvals"

1

AUDITING REPORTS

Our experts will go through your personal and/or business credit report and provide a full audit to meet the underwriting requirements.

2

CUSTOM SEQUENCE

We’ll create a personalized funding sequence tailored to your goals and funding needs to maximize your options.

3

GET FUNDING

After meeting all underwriting requirements, the final step is submitting the applications with the highest chance of approval.

Expert Analysis For Your Success.

EDUCATION FOR THE FUTURE

Our process takes a unique approach, offering coaching sessions, to analyze your barriers to success, and provide you with life-changing solutions!

GUARANTEED FUNDING

We only take on clients that we can guarantee results! We primarily assist with business funding, but we can help with personal funding as well.

300% MORE IN APPROVALS

Leveraging our resources, knowledge, and expertise, our clients average 200-300% more in approvals versus what they would typically be approved for!

The Future of Loans

Putting the Power of Finances Back in the People’s Hands

We specialize in Non-QM loans with thousands of programs versus banks or lenders

LOANS

DSCR

SBA

Auto Financing

Term Loans

Equipment Financing

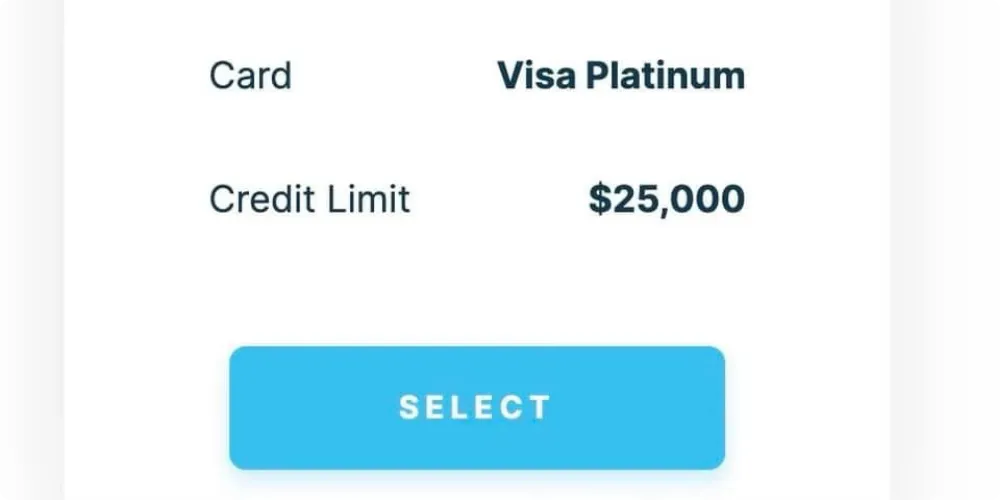

CREDIT CARDS

0% Business Credit

0% Personal Credit

Corporate Credit

Travel Rewards

Cash Back Rewards

LINES OF CREDIT

Business Line of Credit

Home Equity Line of Credit

Personal Line of Credit

Investment Property

Securities Line of Credit

BIZ FINANCING

Merchant Cash Advance

Invoice Financing

Asset Based Lending

Revenue Based

Inventory Financing

MORTGAGE LOANS

Conventional Home Loans

Jumbo Home Loans

FHA Mortgage Loans

VA Mortgage Loans

USDA Mortgage Loans

Bank Statement Loan Programs

First-Time Home Buyer Loans

Reverse Mortgages

Renovation Mortgages

One Time Close Construction

HELOC Loans

REAL ESTATE LOANS

DSCR Investor Loans

Short-Term Rental Property DSCR Loans

Commercial Real Estate Mortgage Loans

Multi-family Real Estate Loans

Hard Money Loans

Bridge, Fix & Flip Loans

Multiple Property Portfolio Loans

Foreign National Mortgage Loans

Land Loans

Ground Up Construction Loans

Fixed Rate Second Mortgage Loans

Choose One Option

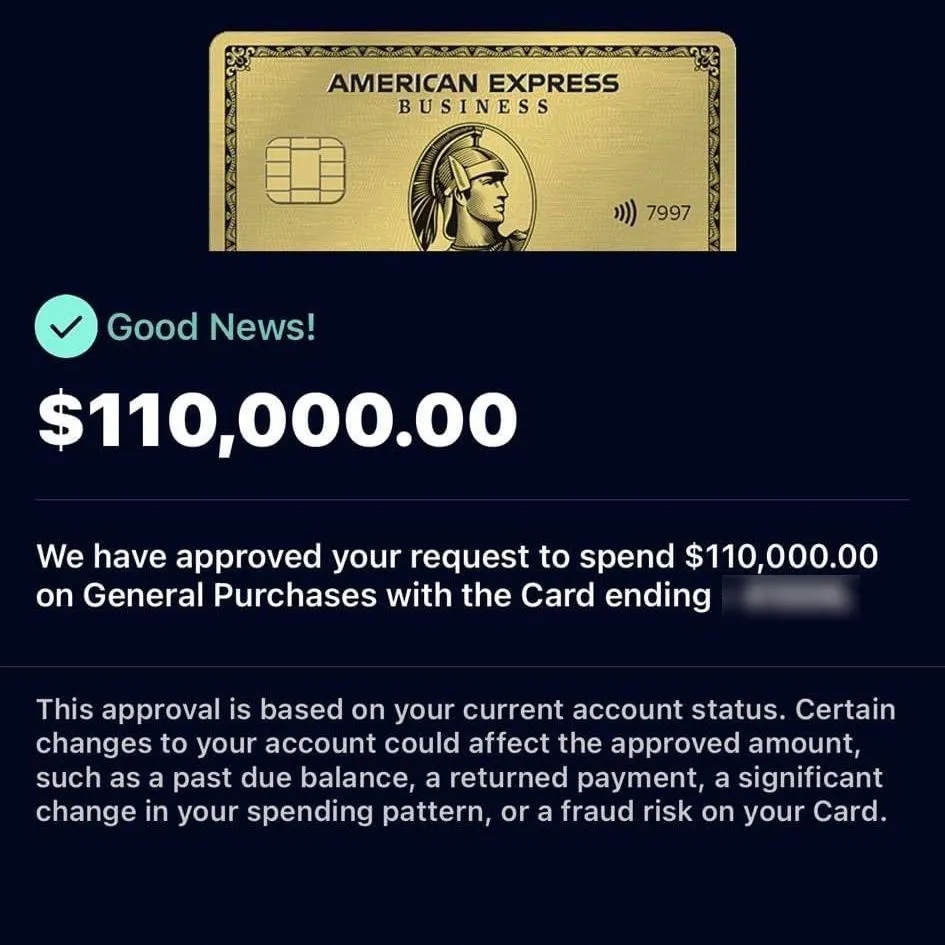

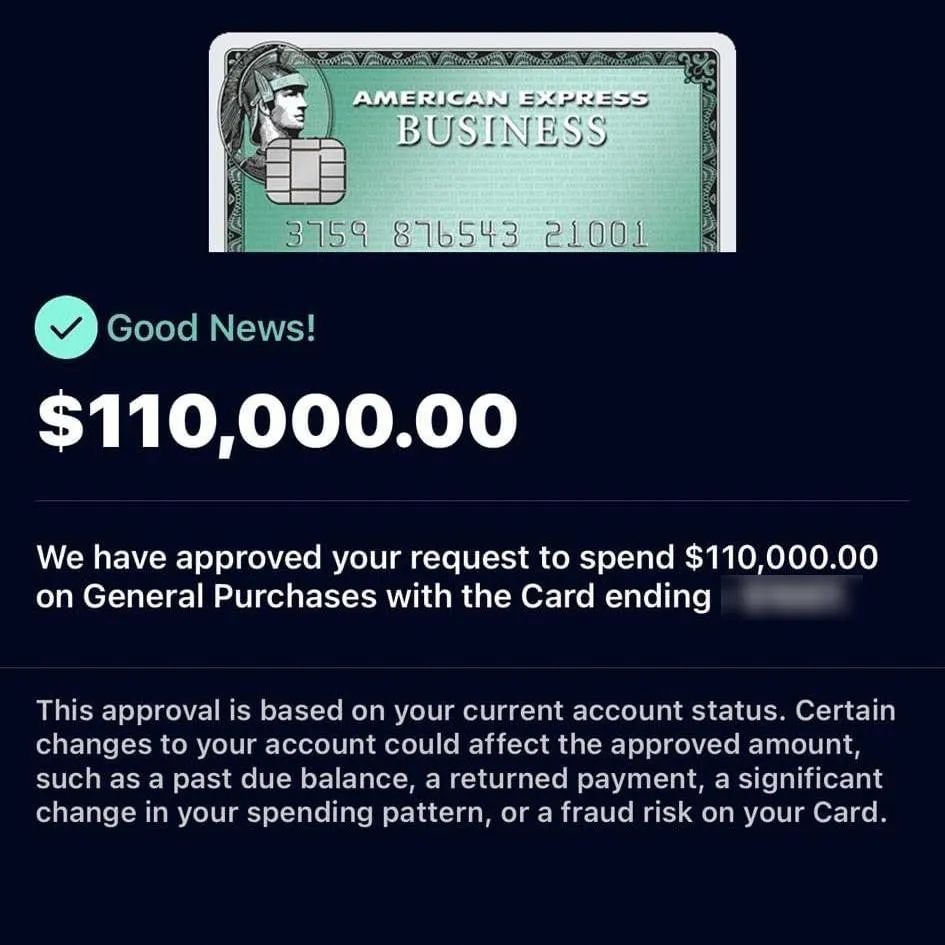

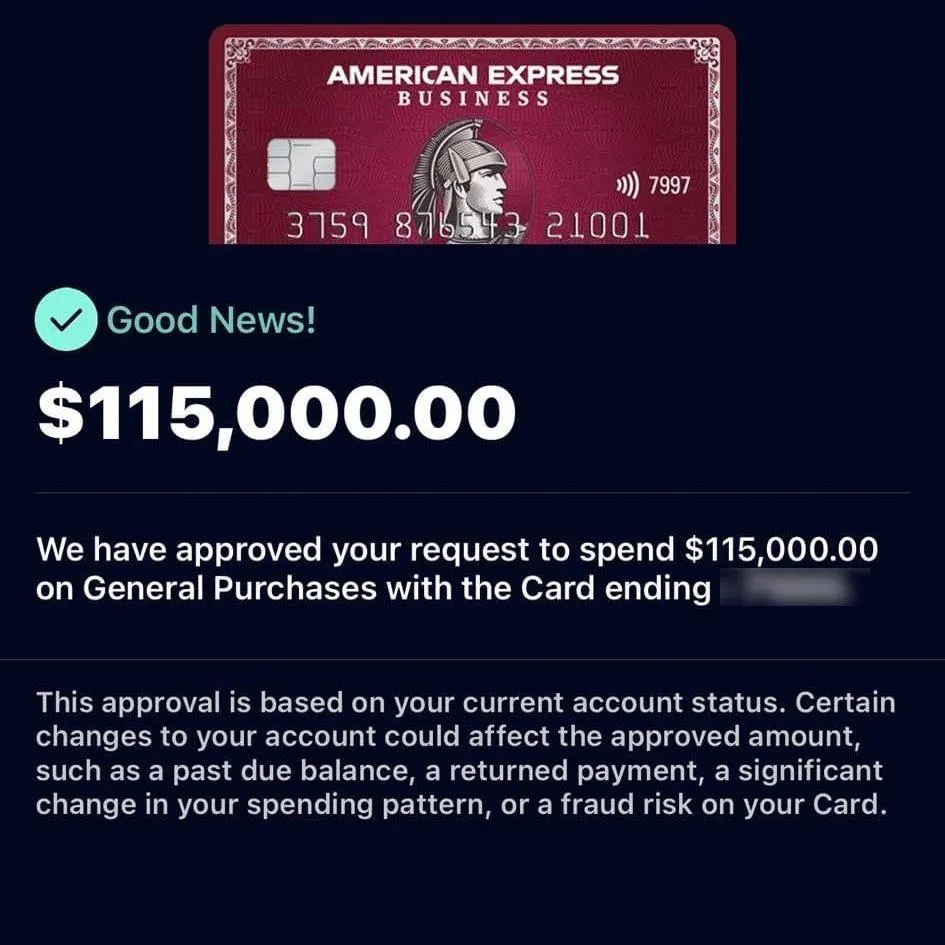

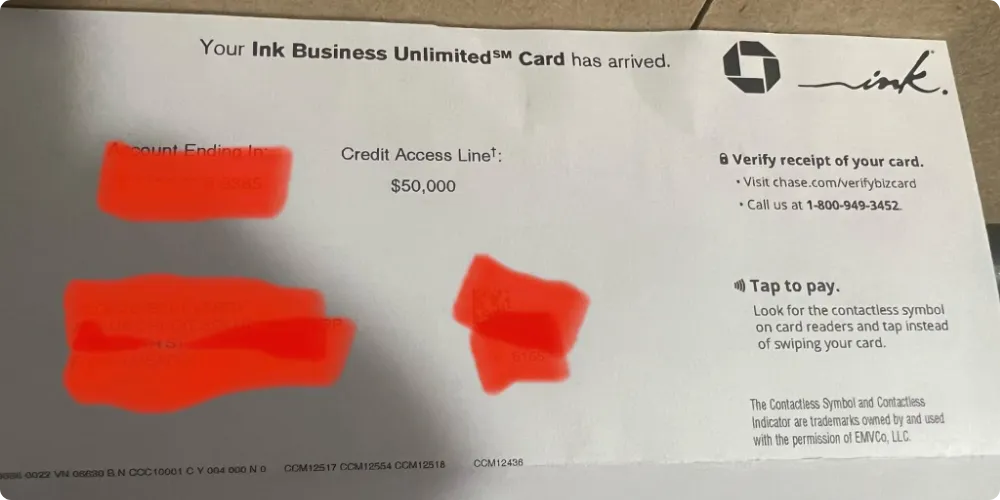

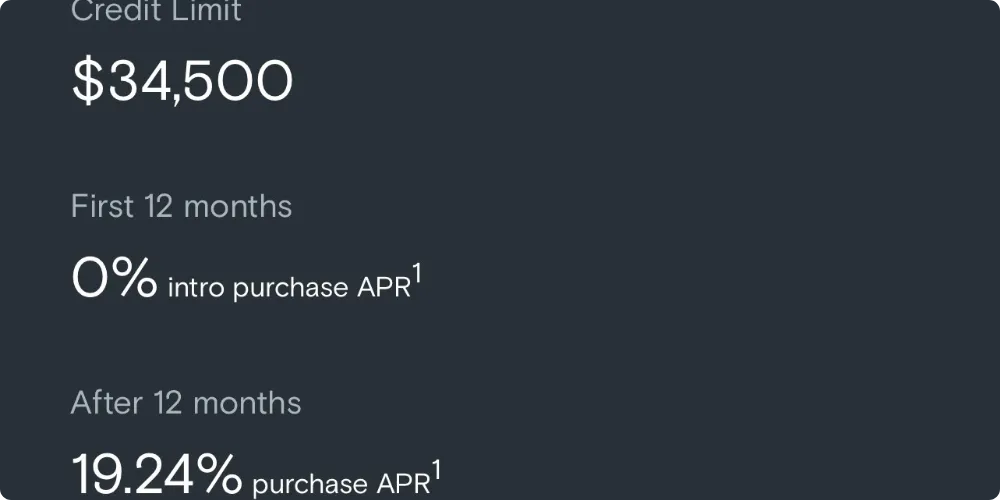

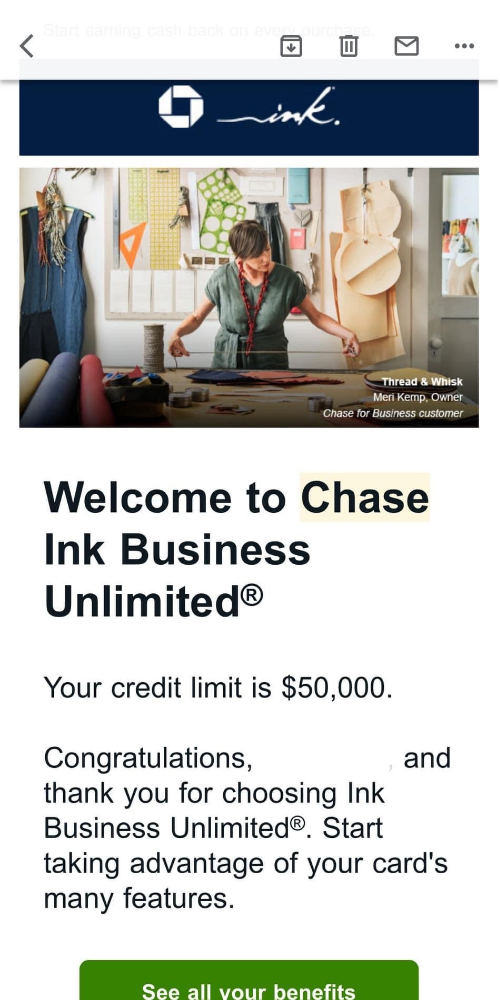

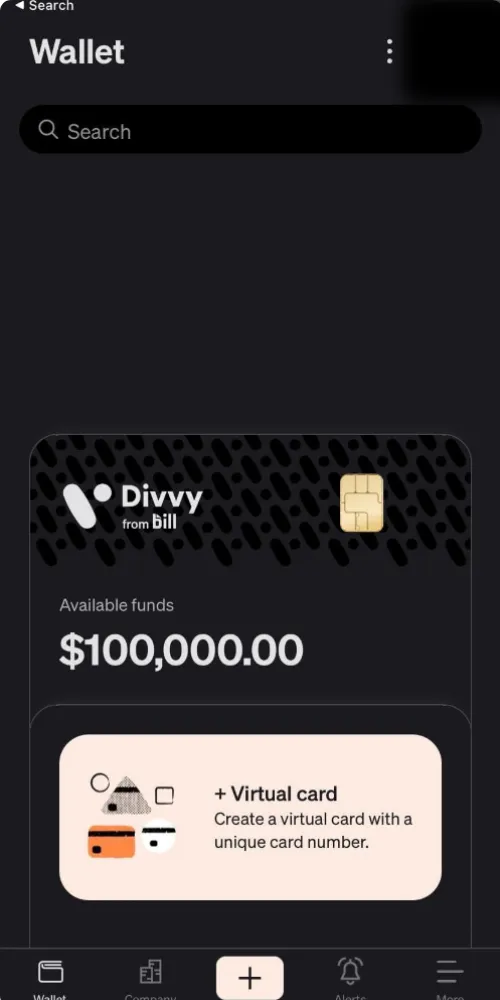

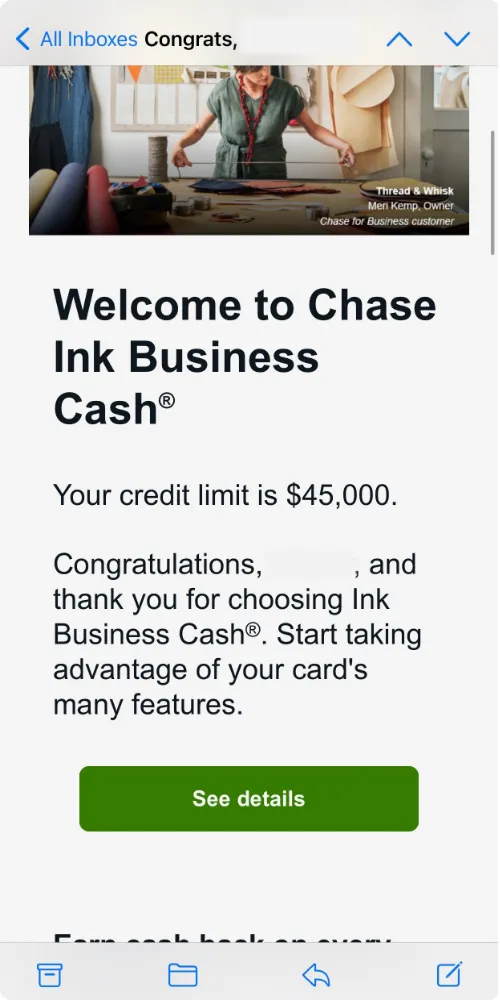

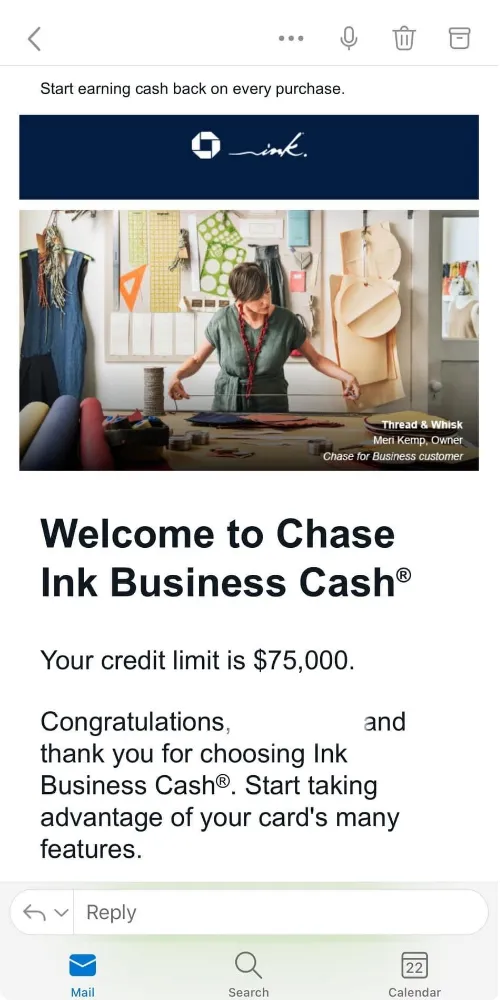

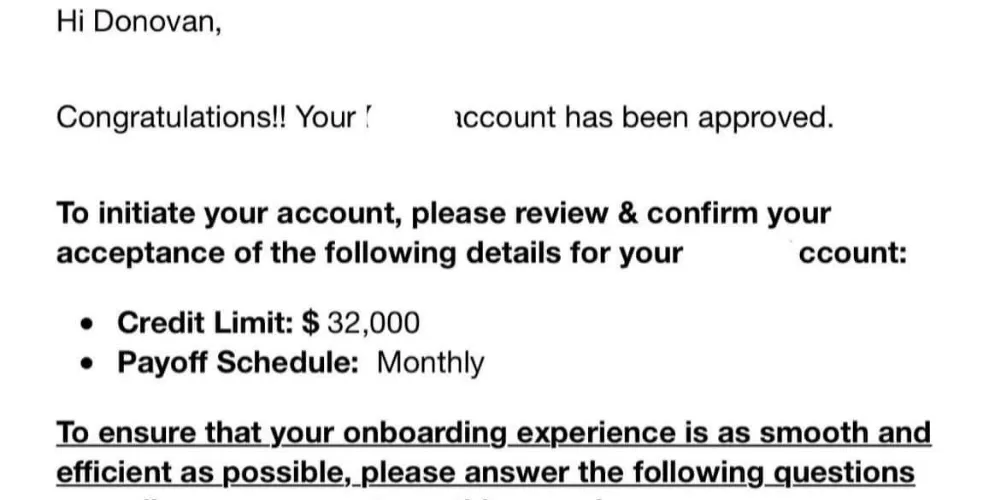

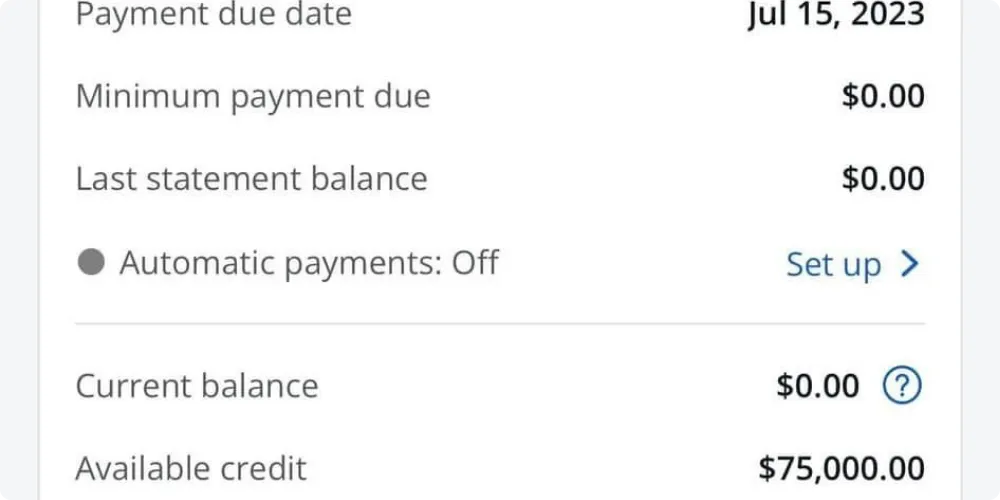

Our Work

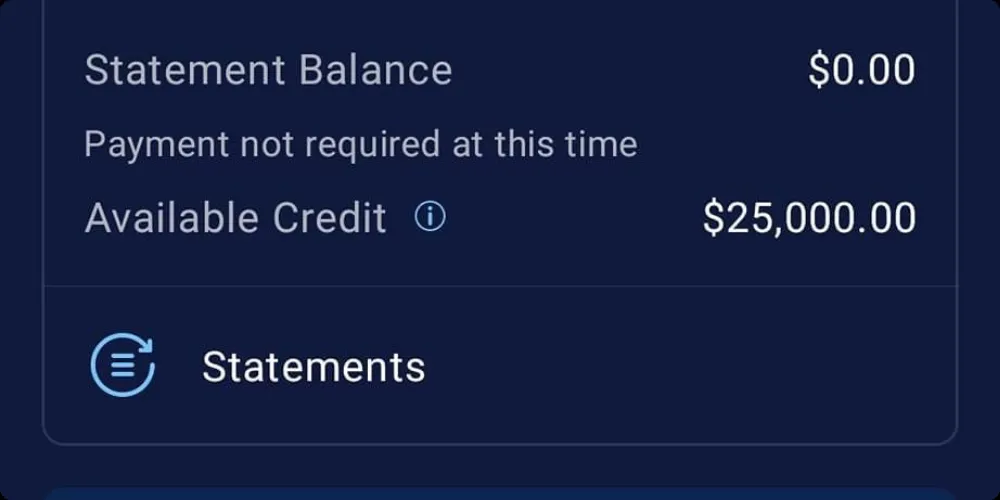

Real People, Real Results

We have funded millions for our clients using our custom process!